Découvrez le cœur spirituel de la Bretagne

Sainte-Anne d’Auray

Un lieu de pèlerinage et d’histoire!

À propos de Sainte-Anne d’Auray

Un Voyage à Travers le Temps

Au cœur de la Bretagne, Sainte-Anne d’Auray est bien plus qu’une simple localité. C’est un lieu où le temps semble s’être arrêté, où chaque pierre, chaque ruelle murmure des histoires d’antan.

Imaginez un instant : les cloches de la basilique tintent doucement, évoquant les échos lointains des pèlerins qui, depuis des siècles, viennent chercher réconfort et inspiration en ces lieux sacrés.

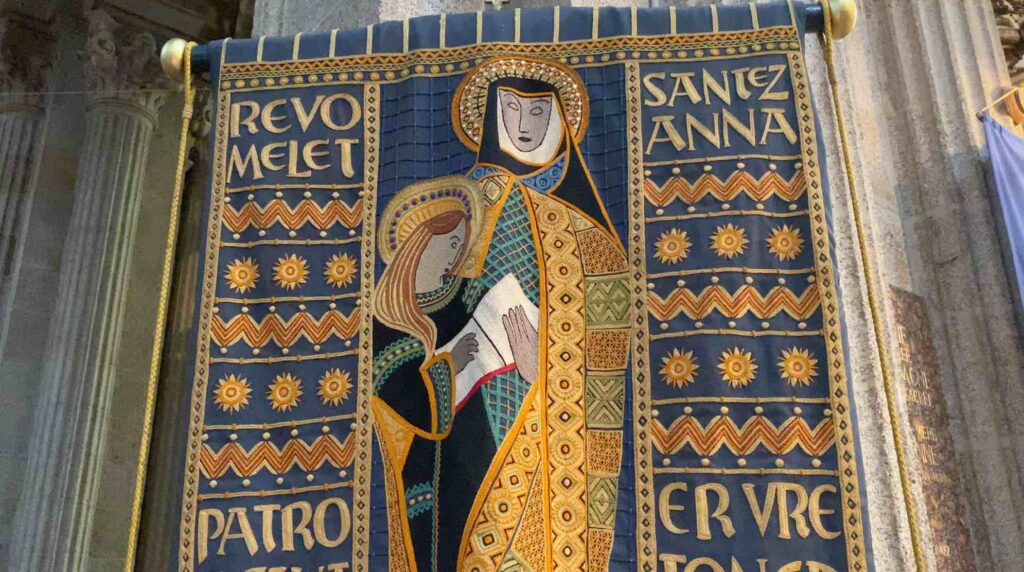

La légende raconte qu’en 1624, un modeste paysan du nom de Yvon Nicolazic fut visité par Sainte Anne, la grand-mère de Jésus. Elle lui aurait confié la mission de retrouver une statue à son effigie, enfouie depuis des siècles.

Guidé par cette vision mystique, Nicolazic découvrit effectivement la statue, marquant ainsi le début d’un pèlerinage qui perdure encore aujourd’hui.

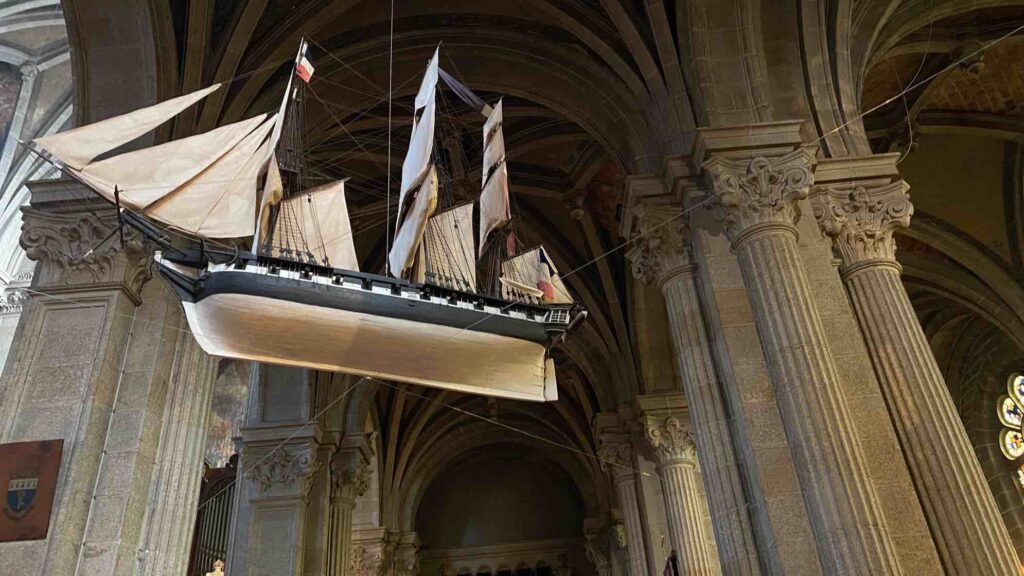

Mais Sainte-Anne d’Auray, ce n’est pas seulement un lieu de dévotion. C’est aussi un témoignage vivant de l’histoire bretonne, un carrefour où se mêlent foi, culture et traditions. Les marchés locaux regorgent de saveurs et de couleurs, reflétant la richesse d’une région fière de son héritage.

L’importance de Sainte-Anne d’Auray ne se mesure pas seulement à son riche passé, mais aussi à son rôle actuel en tant que phare spirituel et culturel. Chaque année, des milliers de visiteurs, qu’ils soient croyants ou simplement curieux, sont attirés par cette aura mystique, cherchant à comprendre ce qui rend ce lieu si spécial.

Saine-Anne d’Auray

Pèlerinage et Grand Pardon

Grand Pardon de Sainte-Anne d’Auray le 26 juillet

Sanctuaire

Histoire de Sainte-Anne d’Auray

Dans le doux murmure du vent qui caresse les feuilles des arbres centenaires, on peut presque entendre les récits épiques qui ont façonné Sainte-Anne d’Auray. Cette terre, bénie par la visite de Sainte Anne elle-même, est un véritable livre ouvert sur l’histoire, un lieu où le sacré et le profane se rencontrent et s’entremêlent.

De la vision mystique d’Yvon Nicolazic aux pèlerinages fervents qui ont suivi, Sainte-Anne d’Auray est un témoignage vibrant de la foi et de la dévotion qui ont traversé les siècles.

Basilique de Sainte-Anne d’Auray

Basilique Sainte-Anne d’Auray – Infos pratiques

Tro Breiz : Sur les pas des Saints Bretons

Pèlerinage et Pardons en Bretagne : Voyage spirituel au cœur de la tradition bretonne

Pèlerinage à Sainte-Anne d’Auray : guide complet

Visite du pape Jean-Paul II à Sainte-Anne d’Auray

L’histoire fascinante de Sainte-Anne d’Auray

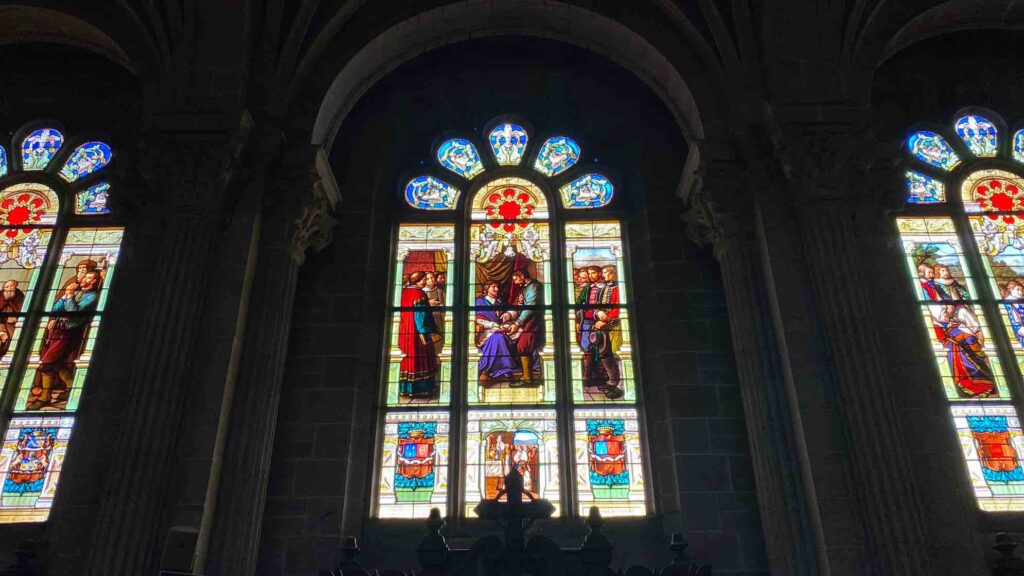

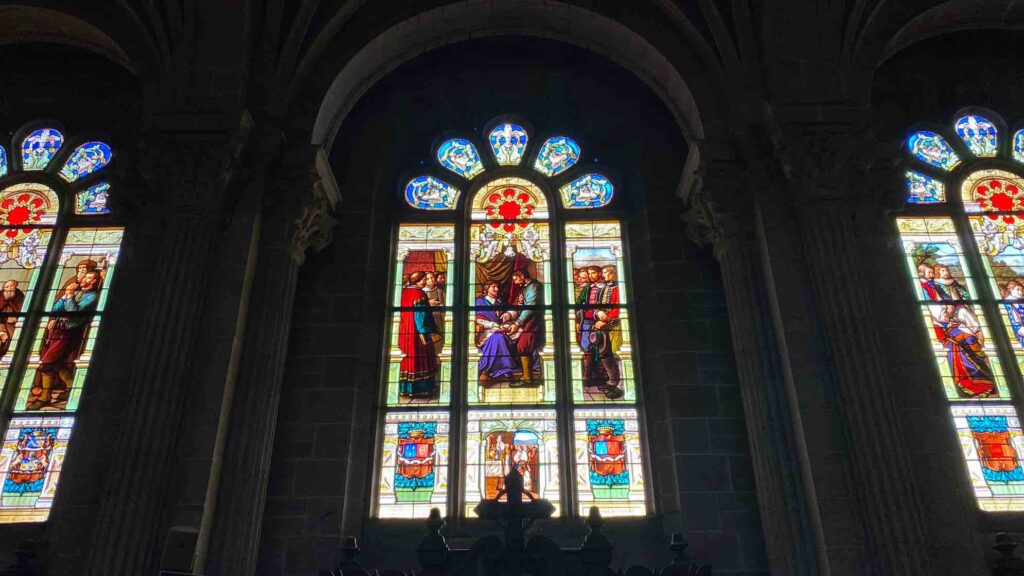

La Basilique de Sainte-Anne d’Auray

Sainte-Anne d’Auray & environs : Joyau breton à explorer

Ce que disent les pèlerins de Sainte-Anne d’Auray

Témoignages

La première fois que j’ai mis les pieds à Sainte-Anne d’Auray, j’ai ressenti une émotion indescriptible. Ce n’était pas seulement la beauté du lieu, mais aussi cette sensation palpable de paix et de sérénité. Chaque fois que je reviens, je retrouve cette même chaleur, ce sentiment d’être à la maison..

Marie, Nantes

Je ne suis pas particulièrement religieuse, mais Sainte-Anne d’Auray a quelque chose de spécial. Les histoires, les légendes, l’architecture… Tout semble raconter une histoire. C’est un lieu où l’on peut se perdre dans ses pensées et vraiment se connecter à quelque chose de plus grand.

Chloée, Paris

Sainte-Anne d’Auray, pour moi, c’est un retour aux sources. Mes grands-parents m’y emmenaient quand j’étais enfant. Aujourd’hui, je continue la tradition avec mes petits-enfants. C’est un lieu de mémoire, de recueillement, mais aussi de joie et de partage.